Recently, the Kentucky House passed HB8, one of the most transformative bills to be considered the House floor in decades. The members who brought the bill forward had campaigned on tax modernization and worked to make this bill a reality for years, and at last, it was time to debate the facts.

Essentially, HB8 intended to use the extra money in Kentucky’s coffers to provide tax relief to Kentucky’s workers by reducing the personal income tax from 5% to 4% in 2023. Then, if certain financial triggers were met, meaning that the increased sales tax on certain services like ride sharing and personal investment services made up for twice the triggered drop in income tax, the tax would continue to drop, until it was zero. In other words, if there was an additional $1B in the bank after a revenue cycle, Kentucky’s workers would see another 1% drop, representing approximately $500 million. These drops would continue at regular intervals until our income tax was zero.

Much of the two-hour-plus debate centered on specific questions about inflation (answer: the trigger is twice the next drop in income, and only a war would push inflation that high), comparisons to other states with no income tax (is it all about tourism? what did Kansas get wrong?), and particular new taxes on services (why monitoring of home security?).

The primary question on this bill is why. Why cut personal income taxes? How can that benefit a state? First, I agree with the presenting sponsor Representative Jason Petrie (District 16) who said over and over that the surplus in Kentucky’s budget, in contrast to what Jefferson County’s Democrats believe, are dollars that belong to the people of Kentucky. Our legislators’ responsible spending in Frankfort is saving us money. The answer is not to appropriate extra funds to the government for spending; the answer is to get them back to the people. Second, as many House GOP members reiterated on the floor, we must have an eye on the future. That means attracting people to move into our great Commonwealth, the way people have flocked to our neighbor Tennessee. Of the top ten fastest growing states in the last census, four of them have no income taxes (Texas, Nevada, Washington, and Florida). (In her comments on this point, Mary Lou Marzian declared Kentucky to be a “hateful state,” asked why anyone would want to come to Kentucky, and finally exclaimed, “Do not come to Kentucky!”)

Want more people? Have more babies.

Democratic Representatives had various arguments why a cut in income taxes would not inspire people to move to Kentucky, mostly involving our lack of Dollywood, warm winters, and curiously, the Permian Basin. Louisville’s Josie Raymond (candidate for the new KY 41) had a different, rather bizarre line of reasoning: Stop focusing on getting to people to move here, and start having babies instead. Quote: “If we want population growth, we’ve got to get the birth rate up.”

Naturally, Raymond had ulterior motives for this argument. She’s not on the front lines of promoting more procreation in the Commonwealth; in fact, I found the reasoning rather ironic for one of the legislature’s most passionate proponents of pro-choice legislation. So, why talk about getting the birth rate up? It was to put in a plug for her spending priorities in Frankfort, languishing under the GOP majority’s desire to return the extra money to the people instead of spending it.

Specifically, Raymond wants Frankfort to spend more money on “things that can make millennials and Zoomers feel secure enough to reproduce.” In her opinion, these things are paid leave, childcare, loan forgiveness, and climate protections. The problem is that this position is completely unfounded, most notably and recently debunked in the book Empty Planet, meticulously researched and presented by two (liberal) Canadian journalists.

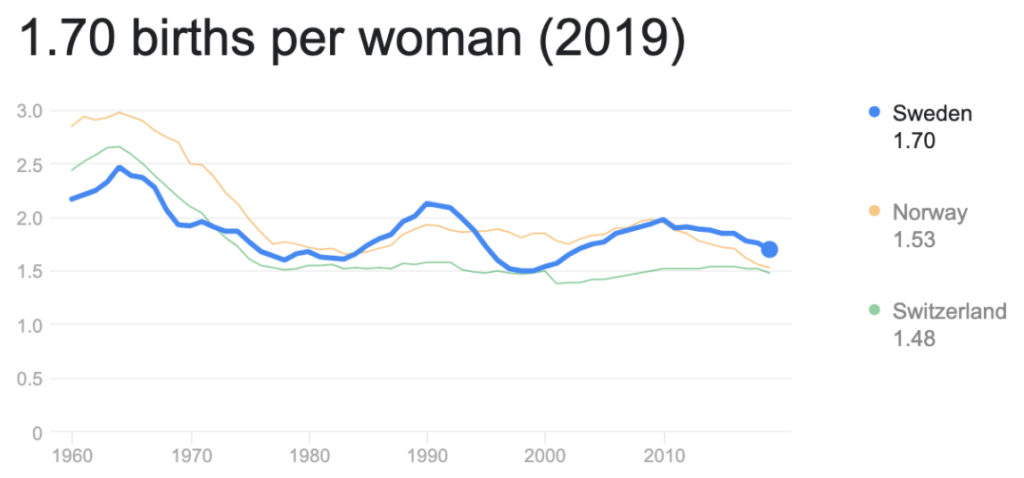

Let’s take a look at real numbers, comparing our birth rate to that of countries that actually have these supposed comfort provisions for baby-making millennials. Kentucky’s birth rate is 62.6 births per 1,000 women aged 18-45. But it’s more helpful to use the U.S. fertility rate for comparison purposes, since that’s the statistic readily available for other countries as well. The United States, the only country among these 41 nations that does not offer paid parental leave, now has a fertility rate of 1.7 births per woman, significantly below the replacement rate of 2.2. If providing paid leave, childcare, loan forgiveness, and climate protections inspires more childbearing, then countries who do those things should have a higher birth rate. But that is simply not true.

First, take Germany. It’s fairly high on that list. When you are pregnant, your employer doesn’t have to pay for your leave, but you apply to receive money from the government instead of your salary. The leave is a total of 14 weeks, 6 weeks before birth and 8 weeks after. In Berlin and Hamburg, parents receive free childcare from birth. The German government also offers paid college, and the country leads in climate-saving strategies, aiming to become greenhouse-gas neutral by 2045 and cutting emissions by at least 65 percent by 2030. What is Germany’s fertility rate? German women have 1.54 children, almost 10% lower than the U.S. rate.

Finland and Sweden are close behind Germany in the nice, long, guaranteed leave for women having babies. In Sweden, college education is free, and additional childcare is free from ages 3 to 6. Also, it’s the land of Greta Thunberg, the land that is the leader of all the leaders in climate change action. The independent Climate Change Performance Index (CCPI) ranks the world’s countries based on a variety of climate criteria. In 2020 Sweden tops the list again, for the third year in a row. What’s Sweden’s birth rate? It is 1.7. – the same as the U.S. And as Sweden has developed a socialistic society much like what I believe Raymond would like to see here in Kentucky, the socialism has decidedly not boosted the birth rate.

Let’s do one more- Finland. Finland guarantees paid leave to both parents for up to 13 weeks, with leave overall guaranteed for 164 days. Not only is attending university free in Finland, but also students are provided a monthly stipend of roughly 500 euros. On the climate issue, Finland aims to achieve carbon neutrality by 2035 and reduce greenhouse gas emissions by 80% by 2050. And Finland’s birth rate is an abysmal 1.37 births per woman.

Representative Raymond, check the income level in District 41, which includes some of the wealthiest neighborhoods in the city, which are also some of the most childless. Income is not why people are not having children. It’s because they do not want children. As Bricker and Ibbitson note in Empty Planet, people have more children because they need them, or want them, often because of a faith background. This is often actually a character issue. When we see a child as an eternal treasure that is worth losing sleep, gaining weight, and dropping a quarter of a million dollars on, then we’ll see more children playing in our yards and parks.

What the rich will & won’t do with extra $$

Arguing for home-grown increase in population wasn’t Raymond’s only bizarre opposition to tax cuts. She also went for the Democratic party line of tax cuts mostly benefiting the wealthy. Because these cuts are a percentage cut, of course, she’s right – the more money you make, the more money you’ll keep with these cuts to personal income tax. And like all good Democrats, Raymond seems to oppose the wealthy. She made three main points about how the wealthy use their money, and all three of them were baseless.

First, she said, “Those folks likely won’t create jobs with it.” I’m not sure what made her an expert on what the wealthy do and don’t do in creating jobs, because she didn’t offer any background for this line of reasoning. Here’s my question: Who do you think creates jobs, people with money, or people without it? The answer is obvious, and if the rich people who save money here choose to create jobs with it, Kentucky wins.

Her second argument was that “they won’t spend it; they’ve already got everything they need.” Again, there was no evidence for this thought. I’m not sure what she thinks the wealthy do with their money, but I see a lot of expensive landscaping, home improvements, luxury cars, pricey wine, and fancy handbags as I wander around District 41. They do spend it, and when they do, they pay sales tax – and Kentucky wins.

Third, she declared what she thought they would do with their money: “They’re likely going to invest it and create more generational wealth for their own families.” My first thought is that’s their prerogative. It’s their money. Good for them. But within the context of the argument on sales tax, she just boosted the GOP sponsors’ point. Did you catch what I mentioned above that was added as a service sales tax within this bill? It’s personal investment services, which someone else in the debate pointed out is used primarily by wealthy people investing outside their retirement 401Ks and pensions (which are not part of this tax). So in conclusion, Representative Raymond, if you are right, and the wealthy who save money with this tax cut do not create jobs, and do not spend it, but instead choose to invest it for their families, they’ll pay taxes on that service, and you guessed it – Kentucky wins.

Recent Comments